This Week's AI Startup Wins: Funding & Deals

Welcome to The AI Signal, where algorithms dream, machines learn, and the future unfolds. The edge of tomorrow comes alive in just 5 minutes. This newsletter guides you through AI’s exhilarating and ever-evolving world.

The AI landscape is evolving at lightning speed, with startups around the world securing massive funding and forging strategic partnerships to redefine industries. From groundbreaking innovations in healthcare to cutting-edge advancements in automation and generative AI, each week brings a new wave of excitement. In this roundup, we spotlight the biggest funding wins and collaborations that are shaping the future of artificial intelligence.

TOP AI FUNDINGS OF THE WEEK

Blaize: Founded in 2011 by former Intel engineers, Blaize focuses on AI chips for edge applications, integrating into smart products like security cameras, drones, and industrial robots. Headquartered in El Dorado Hills, California, it has raised $335 million from investors like Samsung and Mercedes-Benz. Despite reporting losses of $87.5 million in 2023, the company plans to go public via a SPAC deal, valuing it at $1.2 billion, and touts $400 million in potential deals in its pipeline.

Synthesia: The London-based generative AI startup raised $180 million, elevating its valuation to $2.1 billion. The funding round was led by New Enterprise Associates, with participation from GV (formerly Google Ventures) and Accel Partners. Synthesia specializes in creating realistic video avatars for corporate communications and plans to use the funds to enhance the lifelike quality of its avatars.

Cera: U.K.-based healthtech company Cera has raised $150 million in debt and equity to scale its AI-driven in-home healthcare platform, bringing total funding to over $407 million. The platform uses proprietary AI models to predict and reduce patient risks, claiming to cut hospitalizations by up to 70% and saving the NHS £1 million daily. With 10,000 caregivers, Cera serves 30 million people, collaborating with over 150 local governments and two-thirds of NHS Integrated Care Systems.

NEURA Robotics: NEURA Robotics, a German leader in cognitive and humanoid robotics, has raised €120M in Series B funding to advance its AI-powered robots. The company is focused on creating robots with advanced perception capabilities to work safely and seamlessly alongside humans. NEURA's growth has been remarkable, with a 10x revenue increase and a €1 billion order book.

Qventus: Qventus, a healthcare AI startup, has raised $105 million in Series D funding, comprising $85 million in equity and $20 million in optional debt. The funding, led by KKR with participation from Bessemer Venture Partners and strategic investors like Northwestern Medicine, will help expand its AI tools beyond inpatient use to streamline operations across healthcare scenarios. With its valuation now exceeding $400 million, Qventus has quadrupled its customer base and grown three-fold in its core business since its last valuation in 2022.

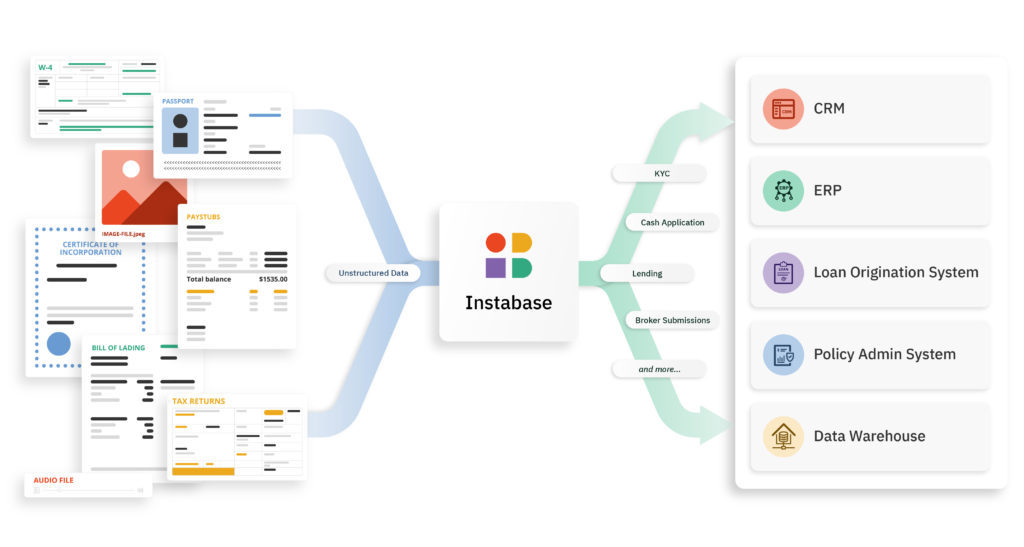

Instabase: Instabase, a San Francisco-based startup specializing in software for extracting and processing unstructured data from various document types, raised $100 million in a Series D funding round. The company helps businesses unlock insights from data in formats like PDFs, emails, and images using AI, including natural language processing and generative AI. Instabase's platform is used by major clients like Uber, AXA, and the USPTO, although its valuation has decreased to $1.24 billion following a down round.

Netradyne: California-based startup Netradyne, which provides AI-enabled dashcams for commercial fleets, has raised $90 million in Series D funding at a pre-money valuation of $1.35 billion. The investment, led by Point72 Private Investments, will fuel global expansion, including entry into Ireland and Japan, and enhance the company’s AI-powered products. Netradyne aims to use its extensive driving data to improve driver safety and develop foundational driving models for autonomous technology.

Eve: An AI startup catering to plaintiffs' law firms, Eve secured $47 million in funding. The round was led by Andreessen Horowitz, with participation from Lightspeed Venture Partners and Menlo Ventures. Eve aims to improve workflows and transparency for personal injury law firms by enhancing client intake, case evaluation, and document drafting processes.

Prophecy: Prophecy, a data copilot company, has announced a $47 million Series B extension to advance the AI-powered data integration market. The round was led by Smith Point Capital, with HSBC joining as a new investor and participation from existing backers like Berkeley SkyDeck and JPMorgan Chase. This new funding follows a 3.5X revenue growth in FY'24 and impressive customer retention rates.

Bioptimus: French AI startup Bioptimus has raised $41 million to develop a foundational AI model focused on biology, enabling simulations to predict disease outcomes and accelerate drug development. Founded in 2023 by experienced AI and biotech leaders, the company has already launched an open-source pathology model and plans to release a multi-modal biological foundation model later this year. Backed by major investors like Cathay Innovation and Sofinnova Partners, Bioptimus aims to revolutionize industries beyond pharmaceuticals, including biotech and cosmetics.

SEEQC: Quantum computing startup SEEQC has raised $30 million in a Series A extension led by Booz Allen Ventures and NordicNinja, with participation from SIP Capital and existing investors. The company, focusing on scalable, energy-efficient quantum computing, aims to simplify quantum hardware by integrating core functions into its chips, addressing challenges like cabling, latency, and scalability. Partnering with Nvidia and global players like BASF and Merck, SEEQC is advancing its technology to accelerate drug discovery and improve quantum-GPU integration for enterprise-grade systems.

Raspberry AI: Raspberry AI, founded two years ago by Cheryl Liu, has revolutionized fashion design with its generative AI platform that transforms sketches into photo-realistic images, helping brands visualize and iterate designs rapidly. The company has attracted major clients like Under Armour, Gruppo Teddy, and MCM Worldwide. Recently, it raised a $24 million Series A led by Andreessen Horowitz to expand its team and venture into home, furniture, and cosmetics design.

Maki: Maki, a Paris-based innovator in conversational AI, has secured £23.4M in Series A funding, positioning itself to transform HR practices globally. The AI-driven tools aim to streamline talent acquisition, reduce bias, and improve hiring efficiency. With major clients like H&M, BNP Paribas, and PwC, Maki is set for significant growth, especially in the U.S., with plans to hire 50-60 new team members and expand its reach.

Coram AI: Coram AI, a pioneer in LLM-powered video security, has raised $13.8 million in Series A funding. The round was led by Battery Ventures, with participation from 8VC and Mosaic Ventures. The company, which specializes in AI-native, hardware-agnostic video security, aims to improve safety and efficiency for sectors like education, manufacturing, and logistics.

RocketPhone.ai: RocketPhone.ai, a London-based AI-powered communication platform, has secured $10.5M in funding to enhance its customer engagement and sales solutions. The platform makes business interactions faster and more effective, helping teams turn conversations into real-time actionable insights. With the recent launch of RocketCell for Salesforce, the company is revolutionizing mobile communication in industries like financial services and automotive.

Nilus: Nilus, an AI-powered treasury management platform, has secured an additional $10 million in funding, raising its total to $18.6 million. The round, led by Felicis and Vesey Ventures with participation from Bessemer Venture Partners, will support the development of its platform designed to enhance cash flow visibility, AI forecasting, and cash reconciliation. Nilus helps fast-growing companies streamline treasury operations, optimize liquidity, and plan for growth.

Hyperline: A next-generation monetisation platform based in Paris and London, Hyperline has raised $10M in a seed extension round led by Index Ventures, bringing its total seed funding to over $14 million. The investment, also supported by Adelie Capital, will help scale its distribution and extend reach beyond early adopters. CEO Lucas Bédout highlights growing demand for their flexible, automated revenue management solution, with customers seeing substantial gains in just weeks.

BforeAI: BforeAI has closed an oversubscribed $10 million Series B funding round, bringing its total funding to over $30 million. Led by Titanium Ventures, the investment will fuel expansion in the utilities, pharmaceutical, and healthcare sectors, while enhancing the company’s PreCrime™ platform. Existing investors SYN Ventures, Karista, and Addendum Capital also participated to maintain their stakes.

Boardy AI: AI networking startup Boardy has raised an $8 million seed round led by Creandum, just months after closing a $3 million pre-seed in October. The platform connects users to valuable contacts through an AI agent that facilitates networking, having already made over 10,000 calls and enabled 9,000 successful connections. Notably, investors approached Boardy organically after trying the product, with participation from notable names like Andy Dunn, Leah Solivan, and Andrew Yeung.

Vasco: Based in Montréal, Vasco secured $8 million in seed funding to advance its AI-powered revenue operations platform. The round was led by Inovia Capital, with participation from BY Venture Partners, FRAMEWORK Venture Partners, and angel investors. The funding will be used to enhance the platform's AI solutions and expand its global client base.

Daash Intelligence: Daash Intelligence, an AI-powered predictive commerce platform for retail brands, has secured $5.5 million in a second seed funding round, bringing its total funding to $8.25 million. The funding, led by Bullpen Capital with participation from GFT Ventures, Silicon Road Ventures, and Red Bike Capital, will be used to scale engineering and go-to-market teams. The company aims to accelerate product development to meet high demand for actionable data insights, helping beauty brands spot market opportunities and optimize their strategies.

Thoras.ai: Thoras.ai closed a $5 million seed funding round on January 15, 2025, led by Wellington Ventures, with participation from several other investors. The company aims to scale its AI-driven platform that enhances reliability and downtime prevention for enterprises. Thoras' unique AI/ML strategy focuses on adaptive observability to improve system performance and uncover root causes.

MetAI: Nvidia has backed Taiwanese startup MetAI in a $4 million seed round to advance its AI-powered digital twin technology, which converts CAD files into functional 3D environments in minutes. MetAI focuses on creating "SimReady" digital twins for semiconductor fabs, smart warehouses, and automation while generating synthetic data for AI training.

Lupa: A London-based AI-native veterinary practice management platform, Lupa raised $4M in seed funding to modernize outdated systems and tap into the $320B global pet market. The company aims to help veterinarians automate administrative tasks and improve client engagement through its AI-powered platform, offering tools like an intelligent assistant and AI-powered scribe. Early trials show Lupa’s platform can save vets up to 10 hours per week, making it 20 times faster to learn than

Open Ledger: Pryce Yebesi, at just 24, has launched Open Ledger, an AI-driven accounting software company, after selling his previous venture, Utopia Labs, to Coinbase. The platform offers embeddable components, APIs, and a ledger database to streamline accounting processes, leveraging AI for tasks like categorization, reconciliation, and financial reporting. Backed by $3 million in funding led by Kindred Ventures and Blank Ventures, Open Ledger plans a full release by month's end, aiming to revolutionize accounting for SaaS companies, fintech, and banks.

LetsData: Ukrainian startup LetsData has secured $1.6 million in pre-seed funding to expand its AI-driven real-time security radar technology, which detects digital disinformation. The company aims to scale its operations in the US and Europe, addressing the growing demand for advanced InfoOps detection. Trusted by high-profile clients such as NATO and UK government agencies, LetsData’s platform has already demonstrated its capability to uncover and counter sophisticated information operations.

TOP COLLABORATIONS OF THE WEEK

Axios: OpenAI has partnered with Axios in a three-year deal to fund the expansion of Axios' local newsletters into four new cities: Pittsburgh, Kansas City, Boulder, and Huntsville. This marks the first time OpenAI is funding a newsroom directly in its partnerships, which also include Vox Media, The Atlantic, and the Financial Times. The goal is to help publishers integrate AI tools to enhance their operations and business models.

Cape Analytics: Moody's announced on January 15, 2025, that it has agreed to acquire Cape Analytics, a geospatial AI startup, for an undisclosed amount. The acquisition, expected to close in Q1, will provide Moody’s with Cape’s geospatial AI technology for insurance underwriting. This will help Moody’s create a property database that offers address-specific risk insights for insurance clients, enhancing its capabilities in AI-driven underwriting solutions.

Read.cv: Perplexity, an AI-powered search engine, has acquired Read.cv, a social media platform for professionals that competed with LinkedIn. As part of the deal, Read.cv will wind down its operations starting January 19, 2025, and users will have until May 16 to export their data. Read.cv, founded in 2021, will now join Perplexity's team to help further its mission of making knowledge more open and accessible.

CoreWeave: CoreWeave, a cloud computing company specializing in AI compute resources, has officially launched its first two data centers in the U.K., marking its expansion outside the U.S. The Crawley facility began operations in October 2024, followed by London Docklands in December, both powered by Nvidia’s H200 GPUs optimized for AI workloads. With 28 active data centers globally, CoreWeave plans to open 10 more in 2025, including sites in Norway, Sweden, and Spain.

Mistral: Mistral has struck a content deal with Agence France-Presse (AFP) to enhance the accuracy of its chatbot, Le Chat. This multi-year agreement grants Le Chat access to AFP’s vast archive of stories across six languages, offering around 2,300 daily updates. The deal marks Mistral’s move beyond being a foundation model maker, positioning itself as a player in the AI content space.

Elevate your experience. Join our community

Please help us get better and suggest new ideas at ceo@theaisignal.com